Over the last few years, Lackawanna County has unveiled new and innovative economic incentives for businesses looking to relocate or expand activities. Lackawanna County is committed to a variety of programs to enhance quality of life, support the growth and development of existing businesses, attract new businesses and industries, create and retain family sustaining jobs, and develop a business-friendly regional reputation.

The United States’ first SBA loan fee waiver program sponsored by Lackawanna County.

Qualified business borrowing from qualified lenders receive reimbursement for SBA loan origination fees incurred.

An economic stimulus that since inception in 2013 created 650 + new jobs, retained 1,700 + jobs, dispersed $1.4mil + to qualified local businesses and leveraged approximately $82mil in funds.

A County-wide, carrier-grade, wireless technology network

Reduces startup and ongoing technology costs for businesses and improves County and emergency management telecommunications.

The Initiative is self-funded and built from the current IT budget.

Reimbursement of all municipal fees and construction permits associated with a business’ relocation or expansion in Lackawanna County.

Designed to incentivize businesses creating permanent, full-time jobs in Lackawanna County.

A County financial commitment to fund neighborhood revitalization projects and increase quality of life.

Designed to assist neighborhood agencies looking to leverage match funds for local and federal grant applications or to complete shovel ready projects.

Lackawanna County established the Business Improvement Grant program in 2016 to promote economic development by encouraging the private sector to pursue facade improvements or purchase/install new equipment or improvements on an existing facility.

Funding is provided through the economic development budget.

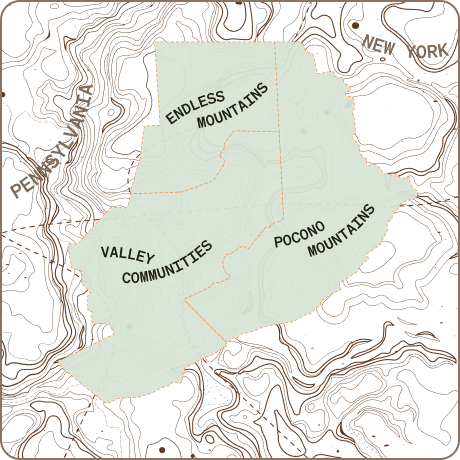

Regional Partners Making an Impact

Northeast Pennsylvania Technology Institute Intellectual Asset Inventory

Searchable database commercializing strategic equipment and intellectual assets of the region’s fourteen colleges and universities.

Learn More >

The following is a list of all state and local taxes that the PA Keystone Opportunity Zones exempts, deducts, abates and/or credits:

State Taxes

- Corporate Net Income Taxes

- Capital Stock & Foreign Franchise Tax

- Personal Income Tax

- Sales & Use Tax

- Bank Shares and Trust Company

- Shares Tax

- Alternative Bank and Trust

- Company Shares Tax

- Mutual Thrift Institutions Tax

- Insurance Premiums Tax

Local Taxes

- Earned Income/Net Profits

- Business Gross Receipts Tax

- Business Occupancy Tax

- Business Privilege & Mercantile Taxes

- Local Real Property Tax

- Sales & Use Tax